Frequently Asked Questions

What is a Public Bank?

Answer: A Public Bank is a bank owned by a national, state, or local government in which all of its funds, taxes, and revenues are deposited. It is mandated to serve a public mission that reflects the values and needs of the public it represents.

Why are public banks exempt from collateral requirements?

From Attorney, Earl Staelin: ““Public deposits” are deposits in a bank that belong to a government and its people, primarily consisting of tax and other revenues.

In the United States, laws governing the chartering of banks generally require a bank that holds public deposits to be a member of the Federal Deposit Insurance Corporation (FDIC) and/or to hold collateral equal to roughly 100% of the amount of its public deposits not insured by the FDIC. The collateral must be liquid or easily made liquid (e.g. short-term Treasuries). The percentage varies by state (in California it is 110%). In general, only major banks are big enough to qualify to hold most public deposits.

The requirements of FDIC membership and 100% collateral for uninsured public deposits were established solely with private banks in mind. For the reasons below, they are completely unnecessary for public banks that follow the Bank of North Dakota (BND) model and would substantially undermine their profitability and effectiveness.

See this detailed discussion of collateral by Earl Staelin, J.D. (Chair of RMPBI): https://publicbankinginstitute.org/new-memo-demonstrates-how-fdic-membership-is-pointless-for-public-banks/

What is the most basic difference between a public and private bank?

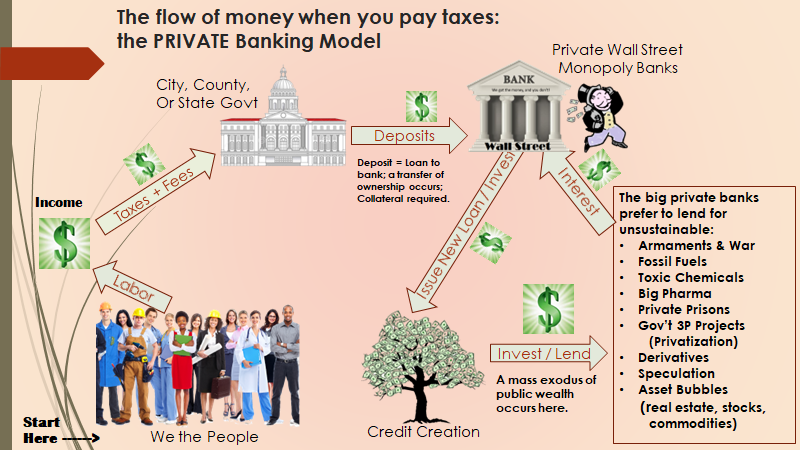

Answer: The most fundamental difference is that a public bank has a mission to serve the public interest while private banks are owned by shareholders and their primary goal is to maximize profit for their shareholders, which can work against the public interest. (See the illustrations below.)

What are the operating principles of a Public Bank?

Answer: All Public Banks should adhere to the following principles:

Transparency. Since a public bank is owned by the people, it is imperative that its operations be open to public scrutiny. The Bank Board, the local government, and the people must have access to information indicating if the bank is operating as intended.

Accountability. The public bank will be accountable to the Governing Board, a Community Advisory Board, the local government, and the people of the community it serves.

Regional Principle. Public banks will be constrained to invest only in the community it serves, returning profits for reinvestment to the taxed community.

Credit Creation. All banks have the powers of credit creation, the ability to create the money supply. There are 3 theories on banking: 1. the Intermediation Theory (banks are just intermediaries between borrowers & depositors), 2. the Fractional Reserve Theory (collectively banks create new money), and 3. the Credit Creation theory. Professor Richard Werner conducted the first ever empirical study to test the 3 theories and verified the Credit Creation theory to be the correct view. Read it here: https://www.sciencedirect.com/science/article/pii/S1057521915001477 Public banks also enjoy the powers of credit creation, and this happens whenever they issue a loan. But unlike Wall Street banks, public banks use that power for the public interest of the community it represents.

Why is Public Banking important now?

Answer: The 2020 Colorado budget is $12.6 billion and the projected deficit is at least $3 billion. This means that either the difference is made up by the federal government, which is highly improbable, or that vital services to the people of Colorado must be substantially curtailed. Public banks in Colorado could avoid that disastrous effect assuming they are adequately funded. Rocky Mountain Public Banking Institute has conducted informal surveys of needs in Colorado indicating that cities, counties, the state, and educational systems are strapped for funds, face cuts of services, and in some cases a request to sell off valuable assets. A public bank could enable local governments to make much more money available by loans for urgent needs such as affordable housing, clean energy, infrastructure (roads, bridges, parks), health care, education, student loans, environmental cleanup, sustainable agriculture, broadband, and independent media, according to the community’s needs, creating a much larger tax base to restore the lost funds, and some of the banks’ income could be paid into the government’s general fund. For more information, please see this blog post discussing how Public Banks could help solve Colorado’s financial crisis.

What community groups and organizations currently support Colorado public banking efforts?

You can find a detailed list of 85+ organizations and numerous community leaders that support the establishment of public banks in Colorado on our Coalition website here: https://coloradopublicbankingcoalition.org

Please sign onto that list and urge your own organizations to do the same!